The Price We Pay for Corporate Money in Campaigns

Washington – If you wonder what price we all pay for corporate money flooding political campaigns ($1.7 billion in 2014), see Exhibit A — the attempt by pharmaceutical giant Pfizer to exploit legal loopholes and renounce its U.S. citizenship to become an Irish company and to duck U.S. corporate income taxes.

Pfizer made no secret that its blockbuster $152 billion merger with Allergan, based in Dublin, was aimed at taking advantage of Ireland’s new 6.3% tax rate, well below the effective tax rate that U.S. multi-nationals pay at home.

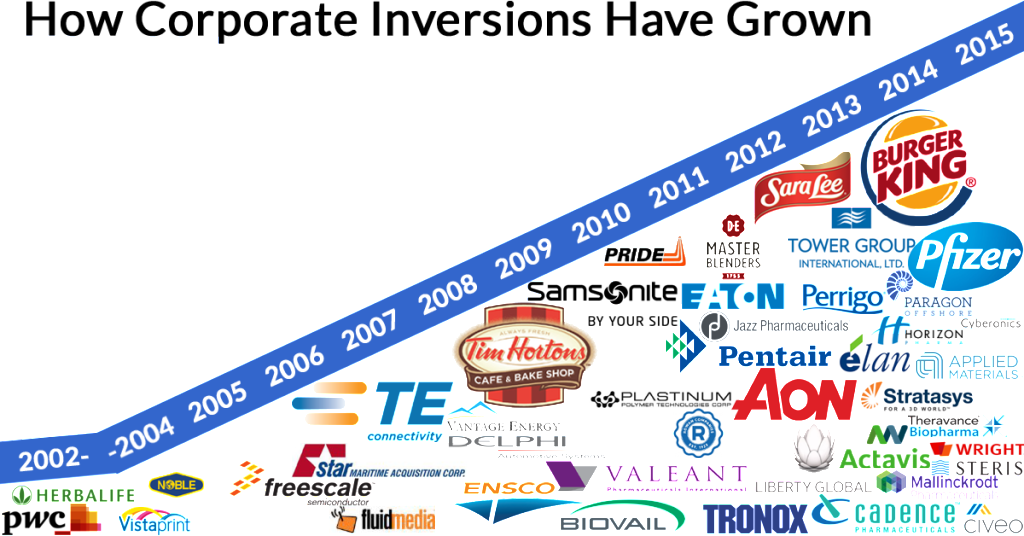

Such deals may seem unpatriotic but they’re legal. Pfizer’s was but the latest of 47 so-called “corporate inversions,” a stratagem dreamed up by Wall Street bankers for U.S. firms over the last decade. American companies flip their legal home address without changing their CEO or their basic operations through foreign mergers that will cost Uncle Sam an estimated $41 billion in lost tax revenues over the next decade, dumping that burden on average taxpayers. Experts estimated that the Pfizer deal would have added another $35 billion in lost taxes.

In the end, Pfizer backed down after being publicly denounced by both Donald Trump and Hillary Clinton and after an ingenious revision of U.S. tax rules by Obama’s Treasury Department to make inversions less profitable. But even after Pfizer scrapped its foreign merger, President Obama warned that Treasury had merely narrowed the loophole for corporate inversions, and that “only Congress can close it for good.” That is, unless corporate campaign donations keep Congress from wanting to act.

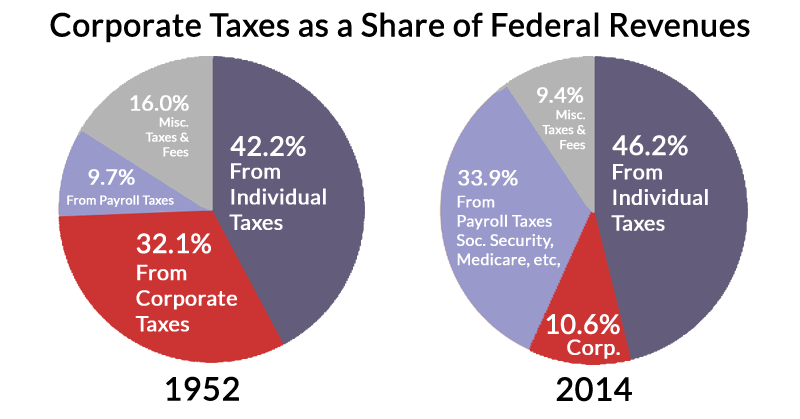

Steep Drop in Corporate Share of Tax Revenues

Inversions, promoted by Wall Street banks that pocketed $1 billion in fees, are the newest gimmick in a long-term trend that has eroded America’s corporate tax base. Since the 1950s, the corporate share of federal tax revenues has fallen steeply from over 30% to just 10% percent today – thanks, not only to a lower corporate tax rate but to $1.2 trillion in corporate tax loopholes passed by Congress.

Foreign tax havens have become the new norm for Corporate America. Major multi-nationals find financial hideaways like Bermuda, Puerto Rico or the Cayman islands where they can set up shell affiliates, often little more than an small office with a big bank account, where they can stash their overseas profits and escape having to pay U.S. taxes.

In 2014, that practice was so pervasive that nearly three-fourths of Fortune 500 companies booked profits to foreign tax havens, according to a study by Citizens for Tax Justice and US PIRG. In all, U.S. companies were hoarding $2.4 trillion in profits offshore – enough to generate $700 billion in U.S. taxes if American companies were to bring all their earnings back home to the United States. President Obama has offered to give U.S. corporations a tax break if they will promise to invest those overseas trillions in modernizing the nation’s aging transport network, but Republicans iN Congress have blocked that move.

Apple Transfers Patents to Escape U.S. Taxes

Even on earnings generated inside the U.S., companies can hop profits over borders with accounting gimmickry. High Tech companies like Apple shift ownership of their prime patents to overseas affiliates. Even though new technology for Apple iPhones and iPads is mostly invented in California for obtaining U.S. patents, Apple says the patents belong to its subsidiary in low-tax Ireland, so that’s where the profits flow and where taxes are paid.

Ditto, Google, Amazon, Microsoft, Gilead, Starbucks, FedEx, Pepsico and many others. Starbucks gave ownership of its secret formulas for roasting coffee to a subsidiary in the Netherlands and got a sweetheart tax deal. Such an outlandish deal, in fact, that European regulators said it violated EU rules on fair competition. So they ordered Starbucks to pay the Dutch government $34 million in back taxes.

Ditto, Google, Amazon, Microsoft, Gilead, Starbucks, FedEx, Pepsico and many others. Starbucks gave ownership of its secret formulas for roasting coffee to a subsidiary in the Netherlands and got a sweetheart tax deal. Such an outlandish deal, in fact, that European regulators said it violated EU rules on fair competition. So they ordered Starbucks to pay the Dutch government $34 million in back taxes.

Apple landed such a sweetheart tax deal with Ireland, where it transferred ownership in some hot technology innovations in its iPhones and iPads, that Apple was accused by European regulators of breaking the law and ordered to pay $14.5 billion in Irish taxes. Regulators said Apple paid Ireland even less than a 1% tax rate for over a decade on its corporate profits, and that in making the deal, the Irish government violated the European Union’s rules on fair competition.

Caterpillar, which makes tractors and heavy earth-movers in Illinois for the global market, concocted a scheme that saved it $2.4 billion in U.S. taxes by having its Swiss subsidiary send out billing invoices to its customers worldwide. So even though Caterpillar tractors were proudly marketed as “Made in America,” Switzerland is where the customers paid their bills and where Caterpillar was taxed – at its own specially negotiated rate of 5%.

If you’re tempted to scream, “There ought to be a law against it!” get in line.

Not only has President Obama called for reforms to block corporate inversion mergers, curb the use of tax havens and tax overseas corporate earnings, but conservative Republican billionaire-candidate Donald Trump denounced Pfizer’s actions as “disgusting” and said, “Our politicians should be ashamed.”

In fact, the Pfizer-Allergan merger prompted congressional calls for reform. “It’s imperative we explore what actions can be taken now,” said Utah’s Republican Senator Orrin Hatch, chair of the Senate Finance Committee. “The best way to resolve these issues would be through comprehensive tax overhaul.” A pregnant idea but an uphill push.

How Big Business Blocked Corporate Tax Reform

The most promising push for corporate tax reform in Congress in recent years began with strong corporate backing and was painstakingly stitched together in 2014 by Michigan Republican Congressman Dave Camp, a pro-business conservative who then chaired the powerful House Ways and Means Committee.

Former Rep. Dave Camp, (R-Mich.) authored major tax reform plan but got shot down by his former corporate supporters. (CC) House GOP

For years, business leaders had clamored for a cut in the corporate tax rate and Camp complied, proposing a cut from 35% to 25%. To raise revenues to offset that cut, Camp proposed closing some big corporate tax loopholes, including the tax exemption on overseas earnings.

Two days after unveiling his tax plan in February 2014, Camp flew to Park City Utah expecting to be feted at a big campaign fund-raiser attended by major corporate lobbyists. Instead, Camp ran into a buzz saw of opposition. Suddenly, the corporate lobbyists who had pushed him into tax reform were angry at him for attacking their loopholes. Within days, they had jawboned 50 congressional Republicans to publicly oppose Camp’s bill.

Corporate opposition killed Camp’s reform plan before it got off the ground, and Camp’s shipwreck became an object lesson for Congress on Corporate America’s ability to block action on tax issues.

Corporate America – $5.8 Billion to Buy Influence

That lesson is reinforced every election cycle by corporate money flooding political campaigns. The Sunlight Foundation, which tracks political money, reports that from 2007 to 2012, America’s 200 most politically active companies spent a whopping $5.8 billion on political campaigns and lobbying in Washington.

Top Corporate donors to congressional campaigns state-by-state – Source: U.S. PIRG

For 2016, corporate funders are already busy targeting congressional races. The Public Interest Research Group (US-PIRG) identified the biggest corporate donor in each of the 50 states: Lockheed-Martin in Texas and Colorado; Fedex in Tennessee; AT&T in Florida and Iowa; Home Depot in Alaska; Koch Industries in Kansas and West Virginia; Comcast in Pennsylvania; Nike in Oregon; Honeywell in New Jersey, North Carolina, Indiana, Utah, Nebraska, and Montana, all seeking friends for business in the next Congress.

The cash flow from Mega donors into campaigns changes constantly but the trend for the 2015-16 election cycle is obvious. The Center for Responsive Politics reports that funds flowing into SuperPACs in 2015 jumped enormously from four years ago. The U.S. Chamber of Commerce, often a bellwether for corporate political spending, has already stepped up its political spending. It’s clear, the Center’s campaign experts conclude, that for anchor campaign contributors like major U.S. corporations “spending has ratcheted up at a pace not seen in previous cycles.”

Hedrick Smith, who conceived this website and is its principal writer and architect, is a Pulitzer Prize-winning former New York Times reporter and Emmy award-winning documentary producer for PBS and PBS FRONTLINE.

Hedrick Smith, who conceived this website and is its principal writer and architect, is a Pulitzer Prize-winning former New York Times reporter and Emmy award-winning documentary producer for PBS and PBS FRONTLINE.

1 Comment